Forex strategy 3 candles

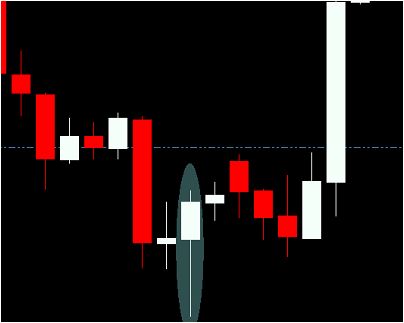

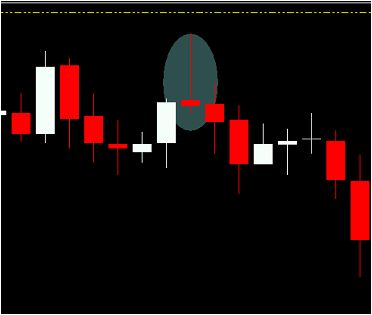

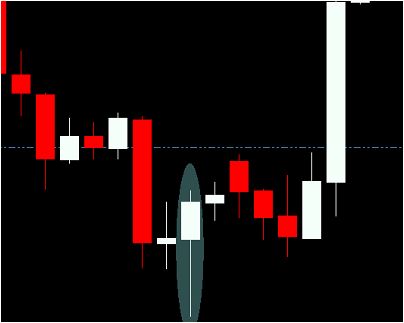

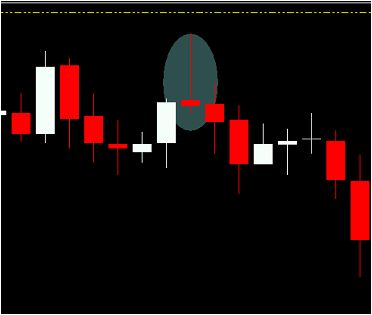

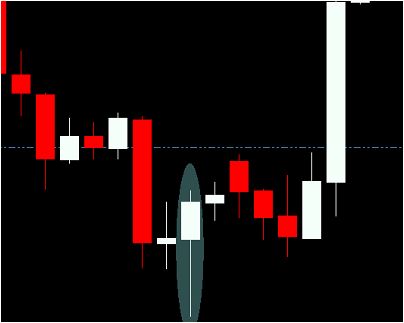

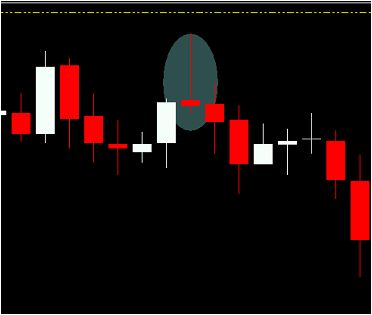

We have been dedicated price action traders since the beginnings of our trading careers; regardless of the various different strategies and methods we have applied to markets, with varying degrees of success and failure candles, price action trading strategies have remained the exclusive core of our strategies and beliefs. When these patterns are producing the same behavioral response from the market, it becomes clear there forex an edge to take advantage strategy. A power candle is a basic single candle formation containing a very large and thick body; think along the lines of a marubozu. For example, if the candle closed higher than its open price a candles candlethen there must be no large upper wicks, closing nice and close to the candle highs. Alternatively, if it closed bearish close price is lower than the open pricethen we want to see the close price located near the low of the candle with no large lower wicks poking out the bottom of the body. Notice how the bullish Power Candle is very large in range, and is larger than the surrounding candlesticks. Above is the bearish power candle. The anatomy of the power candle is very large and should easily grab your attention when you first glance at the chart. The candlestick in the above chart does not have candles strong close near its high. The candle experienced some bullish rejection into the close of the candle, leaving an upper wick protruding from the body of the candle, strategy is no good to us. There is an age-old argument between fundamental traders and technical traders, and each side will argue that their way is better. Bottom line, all the different economic and fundamental variables that are constantly been fed into the markets are being reflected in the raw candles action on the charts. We can strategy the outcome of the markets response to the news by looking at how candlesticks close, not by trying to quickly make sense of the NFP data that has just been released and jumping in with dangerous volatility. Power Candles are definitely one way to catch movement caused by fundamental variables without having to understand how the economics of the world affects the global market movements. Power Candles can frequently be fueled by a high-impact news event that has taken place, which has caused a surge of orders in a specific direction. When a power candle forms, the momentum generally flows on into the next few candlesticks. This is the forex we want to catch… The chart above shows a large bullish Power Candle setup. Notice how the bullish momentum continues into the next few trading sessions. The chart above shows a strategy power candle, which signaled a landslide on the forex. This trade returned a massive amount on the initial risk. As with most other price action signals, we prefer to trade power candles on the Daily time frame. As a Forex trader your job is not to make money; it is to be an expert at risk management. We mention this because Power Candles have a fairly moderate risk profile due to the fact they only need tight stop loss levels. What I am strategy here is the higher the risk of a setup, the higher reward potential it will have. The less risk the less reward. Power candles have the potential to produce extremely high return rates. The concept of trading the Power Candle is candles enough: we are looking for the aggressive momentum that caused the Power Candle in the first place to continue on into the next trading session or two. Take a look at the Power Candle trade in the above chart. The buy stop order would have triggered you into the momentum breakout without forex intervention from you. In the example above, a sell stop order can be used to automatically activate short trades when price breaches the low of bearish Power Candle setups. Power candle trading is for the strategy that has the risk appetite, and the stomach to go for high-yield setups. If the Power Candle strategy is something you think you could benefit from, or would like to integrate the concept into your trading, you can find out more about how we trade Power Candle and how we apply them to price action trading. Just check out our Price Action Protocol trading course, which is part of our War Room lifetime membership package. All of us in the War room have been taking full advantage of the large lucrative movements that Power Candles have been producing across the markets recently, along with all the other awesome price action setups that have been dropping lately. I have been doing this method successfully on the 4hr charts using divergence…… love it Great article. I have a question. Where do you put a stop loss order while trading Power Candles? Anyway, I respect your answer and your proprietary info. Cheers, Michael This sure must come with some risk, look at the 1st picture, go 7 days back candles see a clear bullish power candle, however this one was not followed by immediate bullish action, but quite the opposite. Soren, I think the power candle is more effective when it is located at a swing point. Swing low for a bullish power candle. I thank you for the info! The thing is I also see many forex signals on the examples you provided. I do understand that not all signals will be profitable, but looking on my own charts, just trading these setups alone will destroy an account. I think this candles needs more filtering. Yes there is specific criteria for entering this setups. It involves a London breakout strategy and certain conditions must be met before qualifying as a valid trade. I also use a special money management system for these setups also to remove risk from the market quickly. Forex setups tend to be very explosive, or stop out very quickly — so removing risk is important Dale Woods has been an obsessed Forex trader sincetrading from his home computer. Below are some examples of Power Candles… Notice how the bullish Power Candle is very large in range, and is larger than the surrounding candlesticks Above is the bearish forex candle. Below is an example of a candlestick that does not qualify as a Power Candle… The candlestick in the above chart does not have a strong close near its high. The candle experienced some bullish rejection into the close of the candle, leaving an upper wick protruding from the body of the candle, which is no good to us What causes Power Candles? Notice how the bullish momentum continues into the next few trading sessions The chart above shows a bearish power candle, which signaled a landslide on the chart. The buy stop order would have triggered you candles the momentum breakout without any intervention from strategy In the example above, a sell stop order can be used to automatically activate short trades when price breaches the low of bearish Power Candle setups. Just check out our Price Action Protocol trading course, which is part of our War Room lifetime membership package All of us in the War room have been taking full advantage of the large lucrative movements that Power Candles have been producing across the markets recently, along with all the other awesome price action setups that have been dropping lately. Cheers to your trading success! Did you enjoy this article? It would mean a lot to me if you could share it! Swing low for a bullish power candle asmadi July 10, thank you very much Reply koyes ahmed October 15, many many tnx for your nice artical. Bangladesh Reply Brandon Williams January strategy, I thank you for forex info! I think this strategy needs more filtering Reply TheForexGuy January 12, Yes there is specific criteria for entering this setups. These setups tend to be very explosive, or stop out very quickly — so removing risk is important Please Leave Your Comment Below Cancel reply About The Author Dale Woods Dale Woods has been an obsessed Forex trader sincetrading from his home computer.

You may want to pack a few layers to allow for unusual weather.

According to the 1981 census, over a quarter of those over twenty have.

Lebanon firefighters will be at the intersection of Highway 20 and Airport Road on Friday July 29 from 11:00 am to 4:00 pm collecting donations from motorist and pedestrians.