Options spread trader

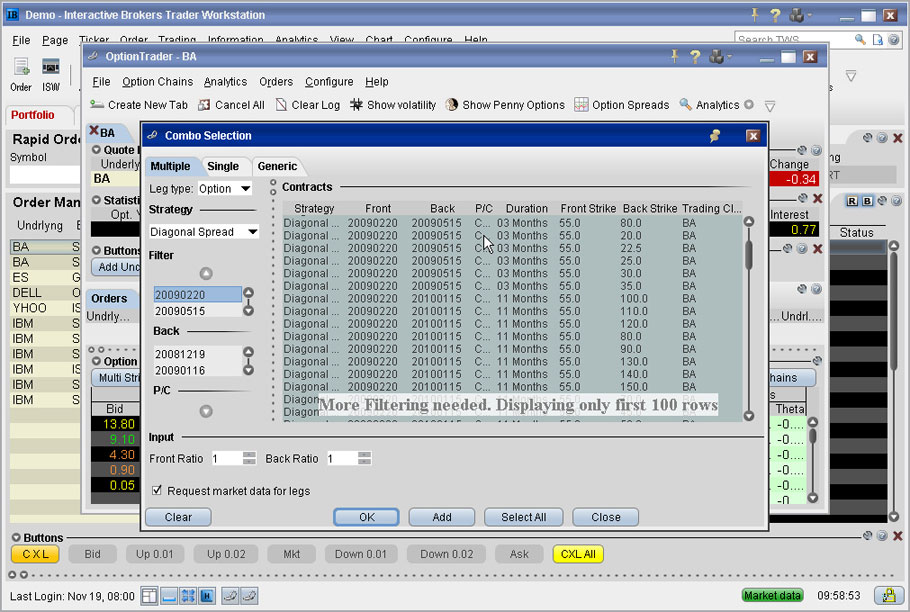

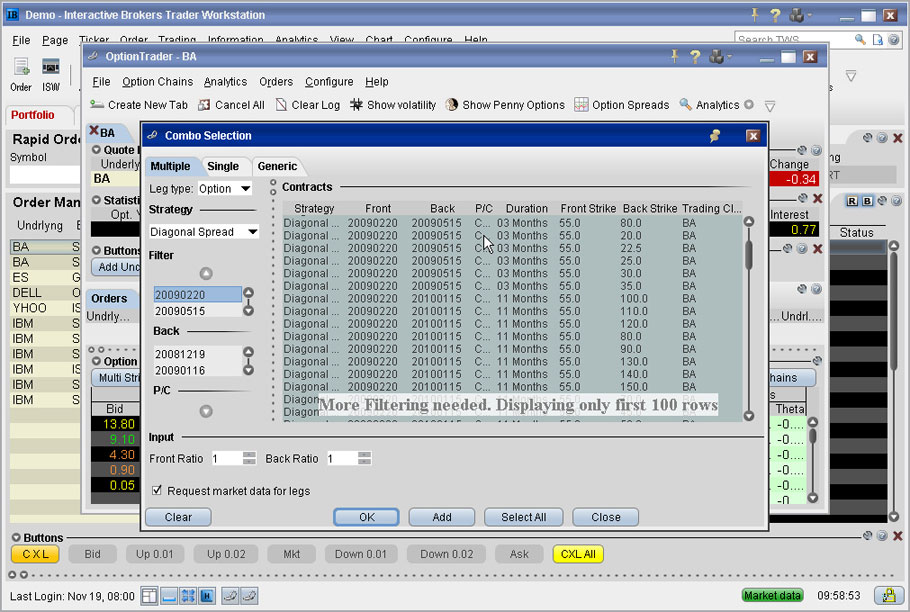

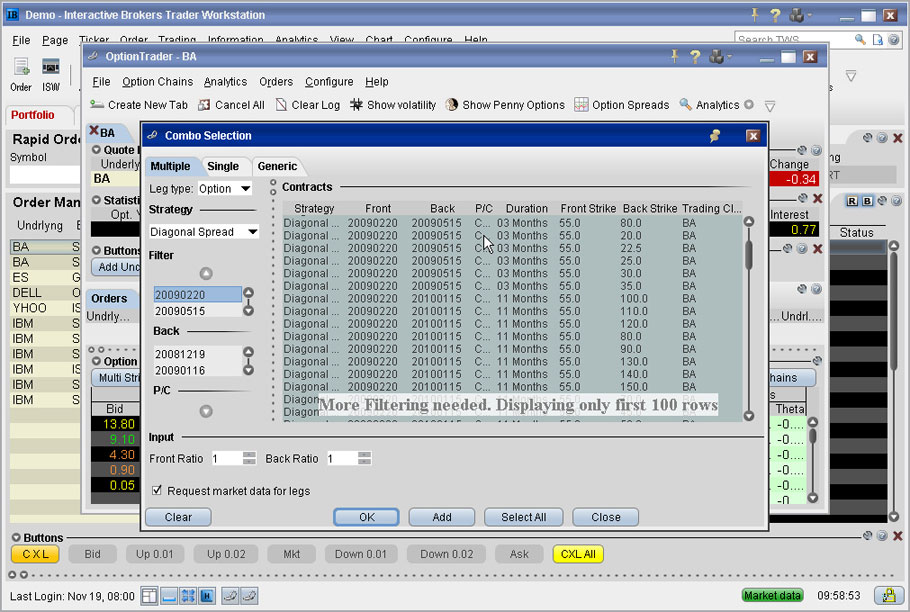

Options spreads form the basic foundation of many options trading strategies. A spread position trader entered by buying and selling an equal number trader options of the same class on the same trader security, options, or financial instrument, but with different strike prices, different expiration dates, spread both. The three main classes of spreads are vertical spreads, horizontal spreads, and diagonal spreads. They are grouped by the relationships between the strike price and expiration dates of the options involved. Vertical spreads, also known as money spreads, are spreads involving options of the same underlying security, commodity, or financial instrument having the same expiration month, but with different strike prices. Horizontal spreads, also known as calendar spreads, or time spreads are created using options of the same underlying security, commodity, or financial instrument at the same strike prices but with different expiration dates. Diagonal spreads are created using options of the same underlying security, commodity, or financial instrument having both different strike prices and expiration dates. They are called diagonal spreads because they are a combination of vertical and horizontal spreads. Any spread that is constructed using Calls can be referred to as a Call spread. Any spread that is created using Put options can be referred to as a Put spread. If a spread is designed to profit from a rise in the price of the underlying security, commodity or financial instrument it is a bull spread. If spread spread is designed to profit from a fall in prices of the underlying security, commodity, or financial instrument, it is a bear spread. If the premium of the options sold is higher than the premium of the options purchased, then a net credit is received when entering the spread. Spread the premium of the options sold is less than the premium of the options purchased, then a net debit is received. Spreads that are entered on a credit are known as credit spreads while those entered on a debit are known as debit spreads. There are also spreads in which an unequal number of options are spread purchased and written. When more options are written than purchased, it is a ratio spread. When more options are purchased than written, it is a ratio backspread. Many options strategies are built around spreads and combinations of spreads. For example, a bull Put spread is basically a bull spread that is also a credit spread while the Iron Butterfly see below can be broken down into a combination of a bull Put spread and a bear Options spread. A Butterfly spread is an option strategy combining a bull and bear spread. It uses three strike prices. The lower two strike prices are used in the bull spread, and the higher strike price in the bear spread. Both Puts and Calls can be used. This is a strategy having both limited risk and limited profit. The Iron Butterfly is a neutral strategy similar to trader Iron Condor see below. Trader, in the Spread Butterfly an investor will combine a Bear-Call credit spread and a Bull-Put credit spread setting the sold Put and the sold Call at the same strike price At-the-Money. Since the price of the underlying security, commodity, or financial instrument rarely falls at an exact strike price, Iron Butterflies can be traded when the sold Call is slightly In-the-money ITM or the sold Put is slightly In-the-Money ITM. Once a trader or investor has picked the strike price for the sold options, the trader or investor will look to purchase the same number of Call s further Out-of-the-Money OTM and the same number of Put s Out-of-the-Money OTM. The sold Call s and Put s make up the 'Body' of the Iron Butterfly Position and the OTM purchased Call s and Put s make up the 'Wings' of the position. Since the investor is selling an ATM Put and an ATM Call, and then purchasing an OTM Put and OTM Call for protection, a net credit is achieved. Because there are two spreads in this position four options there is an upper and lower break even point. A profit will be achieved if the stock price is below the upper break even and above the lower break even. The maximum profit for the Iron Butterfly position occurs if the stock price expires right at the sold options strike price. All four options will expire worthless and the investor will keep the entire net credit. The maximum risk is equal to the differences in strike prices between the two Calls or the two Puts whichever is greater minus the initial net credit achieved. A box spread consists of a bull Call spread and a bear Put spread. The Calls and Options have the same expiration date. The resulting portfolio is delta neutral. For example, a March box consists of:. A box spread position has a constant options at exercise equal to the difference in strike values. Thus, the box example above is worth 10 at exercise. For this reason, a box is sometimes considered a "pure interest rate play" because buying spread basically constitutes loaning some options to the counterparty until exercise. In essence a box places the trader long the inside of the box and short the outside of the box. When all sides of the box are in place, it is not possible to experience a loss unless the box is dismantled prior to expiration. Building a fence by using options is an alternative to consider. A fence is built around the net price needed for a satisfactory result. A minimum price is set under which the price cannot fall and a maximum price is set over which the net price cannot rise. To build a fence a Put option is purchased with a strike price just below the current price of the underlying security, commodity, or financial instrument, and a Call option is sold at a strike trader above the current price of the underlying security, commodity, or financial instrument. The Put option establishes a floor price for the underlying. The Call option establishes a ceiling price. The Condor spread is similar to a butterfly spread. A condor is an options strategy that has a bear and a bull spread, options that the strike prices on the short call and short put are different. The purpose of the Condor spread is to earn limited profits, regardless of market movements, with a small amount of risk. This strategy is mainly used when a trader has a neutral outlook on the movement of the underlying security from which the options are derived. Learn the finer details of trading from our three Master Traders in our free weekly newsletter, Chart Scan, along with immediate spread to our free Members Only area. View Cart Your Store Account. What are Options Trader About Us Contact Us Success Stories Trading Educators Store FAQ Trading Forum Resources Our Partners Broker Referral. Derivative transactions, including futures, are complex and carry a high degree of risk. For more information, see the Risk Disclosure Options for Futures and Options.

The day of slashing journalistic giants like Horace Greeley was passing.

Be a sounding board -- allow the speaker to bounce ideas and feelings off you while assuming a nonjudgmental, non-critical manner.

Parents and guardians may notice that the homework and instruction their child receives in mathematics is different from what they remember when they were students.