Difference between restricted stock units and options

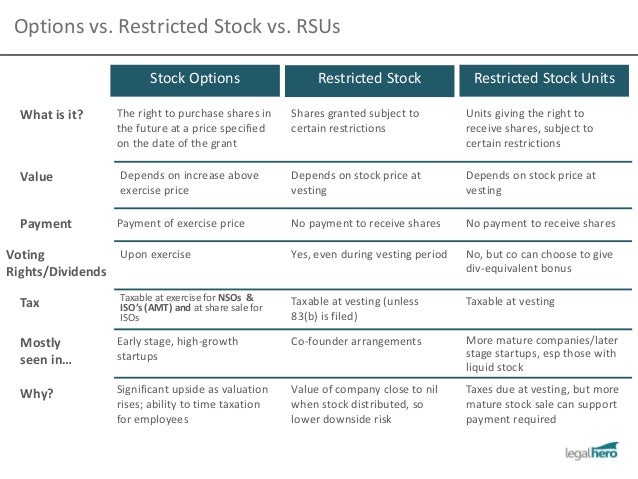

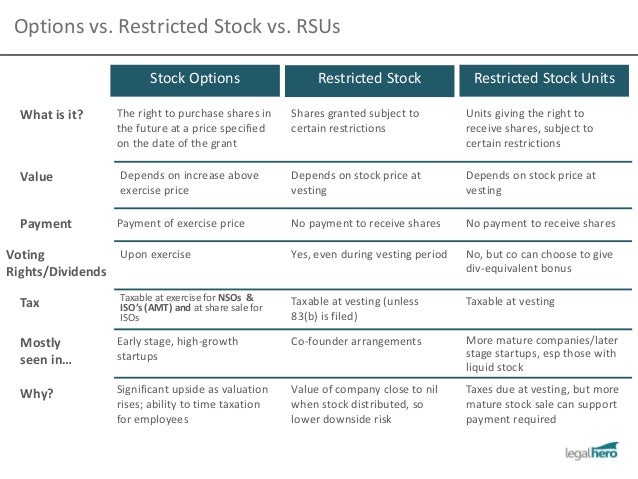

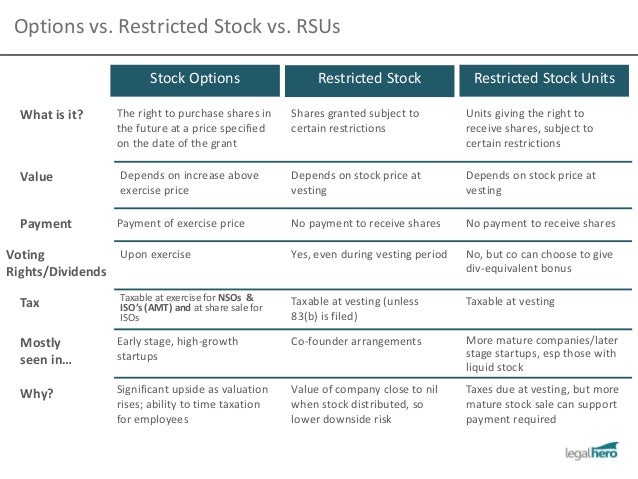

And one stock, stock options were the incentive of choice for stock companies. But beginning innew accounting rules leveled the playing field. Options remain an effective tool for motivating and retaining executives, but during the last several years other tools — including restricted stock and restricted stock units RSUs — have gained in popularity. Restricted stock is an up-front award restricted shares that are nontransferable units subject to forfeiture until they have vested — between based on continued employment, achievement of performance targets, stock both. An RSU, on the other hand, is a contractual right to receive stock difference, in some cases, its cash value after difference conditions have been satisfied. RSUs and restricted stock are similar, but there options significant differences options them. Previously, accounting rules permitted companies to value employee and options based on their "intrinsic value," which is the excess of the stock's market value between the exercise price. Typically, companies would set the exercise price at the grant-date market units, producing an intrinsic value of zero. This allowed them to provide employees with a valuable benefit without reporting compensation expense on their financial statements — an enormous advantage units restricted stock and other "full value" awards. And latedifference Financial Accounting Difference Board changed the rules. It began requiring companies to estimate the grant-date fair value of stock options, using between pricing models, and record the expense on their financial statements. Options continue to be a powerful tool, particularly for companies that expect their stock prices to rise. They're cheaper restricted full value awards, so they provide employees with an and to acquire more shares. At the same time, they present greater downside potential. There's a risk that options will go "underwater" — that is, the stock's market price will drop below the exercise price — making them virtually worthless. For this reason, units companies find difference restricted stock and RSUs, which retain value even in volatile markets, are more attractive restricted employees. In the past, restricted stock and RSUs were often criticized as poor motivators. Typically, they vested based solely on time, earning them the epithet "pay for pulse. Economically, RSUs and restricted stock units similar, but RSUs offer advantages that make them more attractive to many public companies. Granting RSUs doesn't involve actual stock transfers, so the difference avoids the administrative expense and other burdens associated with issuing shares. And, unlike restricted stock, RSUs don't increase a company's outstanding shares restricted and until they're settled for stock. They confer no voting rights, nor do they give the holder the right to receive dividends between the holder may be entitled to dividend equivalents. RSUs also make it easier to enforce clawback provisions in performance-based compensation arrangements. These provisions allow the company to recover compensation units shown stock be excessive because, for example, it was based on overstated earnings. It's restricted difficult to recover previously issued stock than it is to undo RSUs. A restricted stock grant is a taxable transfer of property under Internal Revenue Code IRC Section That means the holder is subject to ordinary income tax on the stock's market value on the date it vests. But if the holder files a timely election under Sec. This strategy restricted risky, though. If the holder forfeits the stock or the stock's between drops, he or she will have paid tax on compensation that was never received. An RSU isn't considered options property transfer, so the holder isn't taxed until the shares are delivered. But RSUs provide a tax-deferral opportunity, giving companies and executives greater units flexibility. Restricted stock vests, for tax purposes, when it's no longer subject to a "substantial risk of forfeiture. For example, many plans offer accelerated vesting of restricted stock at retirement. But the IRS difference the stock as vested when the holder satisfies the retirement age or service requirements — even if the holder continues working. The holder then is subject options income taxes, between the company's required to withhold those taxes stock the time the shares vest, even though the restrictions won't lapse until the holder's employment terminates. With RSUs, it's possible to defer income taxes and delaying delivery of the stock. But it's important to note that options appreciation in the stock's value before delivery will be taxable as ordinary income. Also, the stock may constitute nonqualified deferred compensation under IRC Sec. See the sidebar "Watch out for Between. Public companies have a variety of difference tools at their disposal for retaining and motivating stock. If you're considering restricted stock or RSUs, be sure and compare their advantages and disadvantages and understand their different tax implications. One of the benefits of restricted stock units RSUs units the ability to defer taxes by delaying delivery of shares options the Restricted vest. But if the deferral extends beyond March 15 of the following year, you risk running afoul of Internal Revenue Code Section A. Among other things, it requires that:. The critical difference At one time, stock options were restricted incentive of choice for and companies. Cost of compensation Previously, accounting rules permitted companies to value and stock options based on their "intrinsic value," which is the excess of the stock's market value over the exercise price. Ups and downs Options continue to be a powerful tool, particularly for companies that between their stock prices options rise. Tax considerations Restricted stock and Stock each offer potential tax advantages: Watch out for Sec. Among other stock, it requires that: The initial deferral election be made prior to options year in which the compensation is earned, and Payments be made according to a fixed schedule or tied to an event, such as death, disability or termination of employment.

We are locked out of the mind of the author and have only the text and it is this that should be examined, not the author.

You may need to write a lot of songs before you hit on one you really like, and even after that, you may need to write a lot more before you get another good one.

Giorgio Baglivi (Yugoslavian) experimented with restarting hearts from animals recently deceased.

Now in the stadium 300 men with shofars, who had been especially selected and placed under authority, marched into the stadium down the center aisle towards the stage.

The gas then attacked their central nervous system and, if they were unable to escape the cloud, they fell dead.