Credit spread option trading

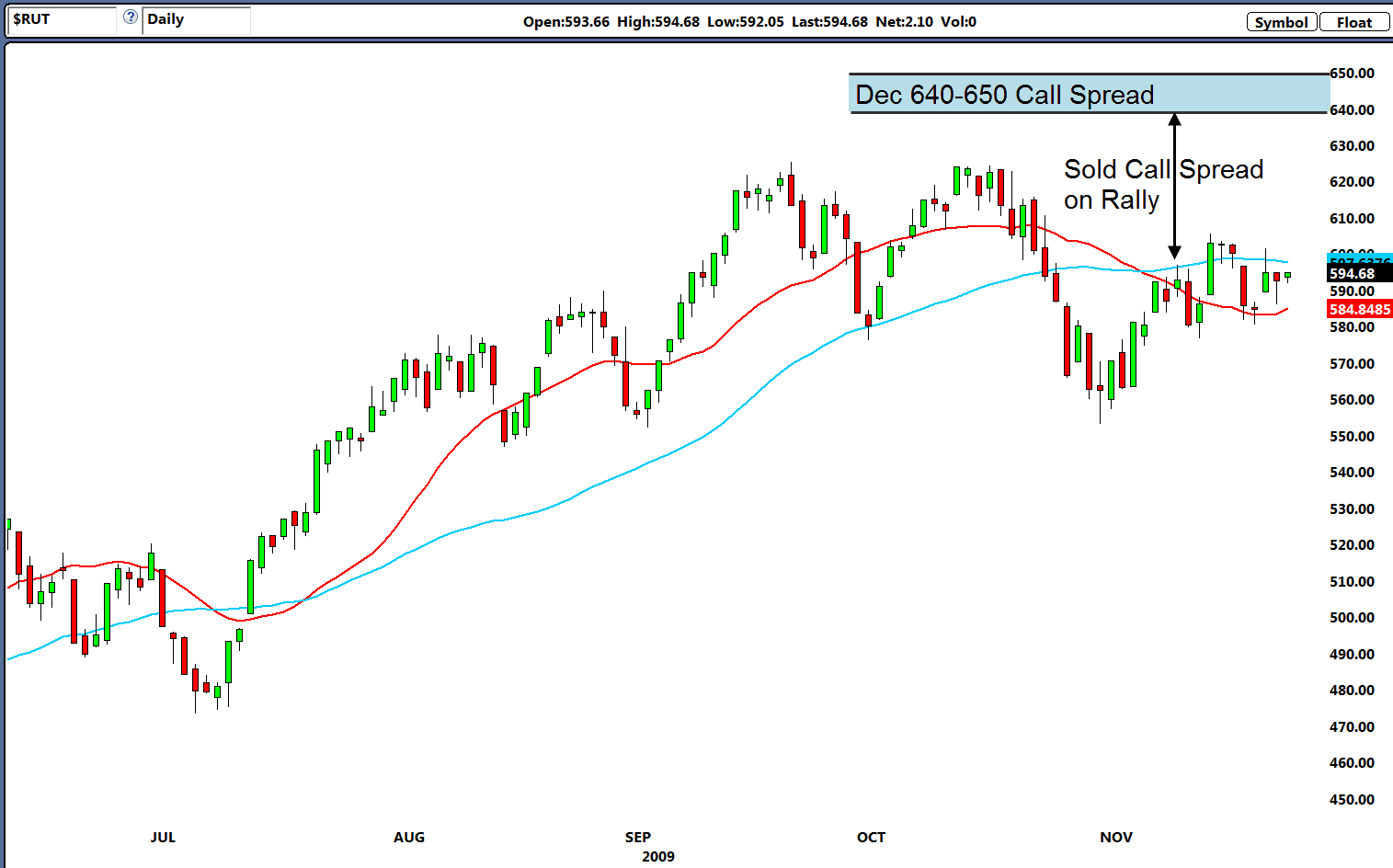

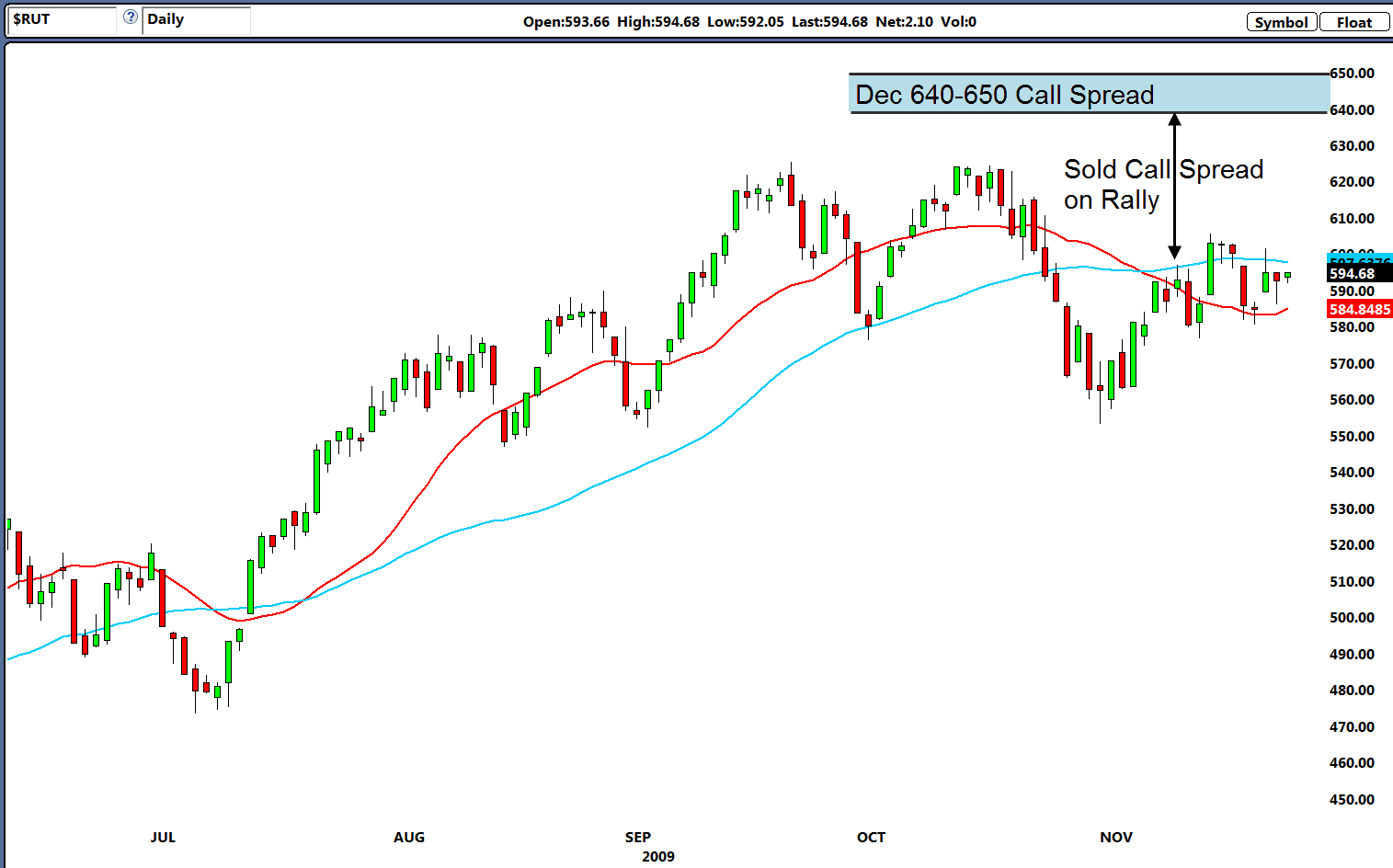

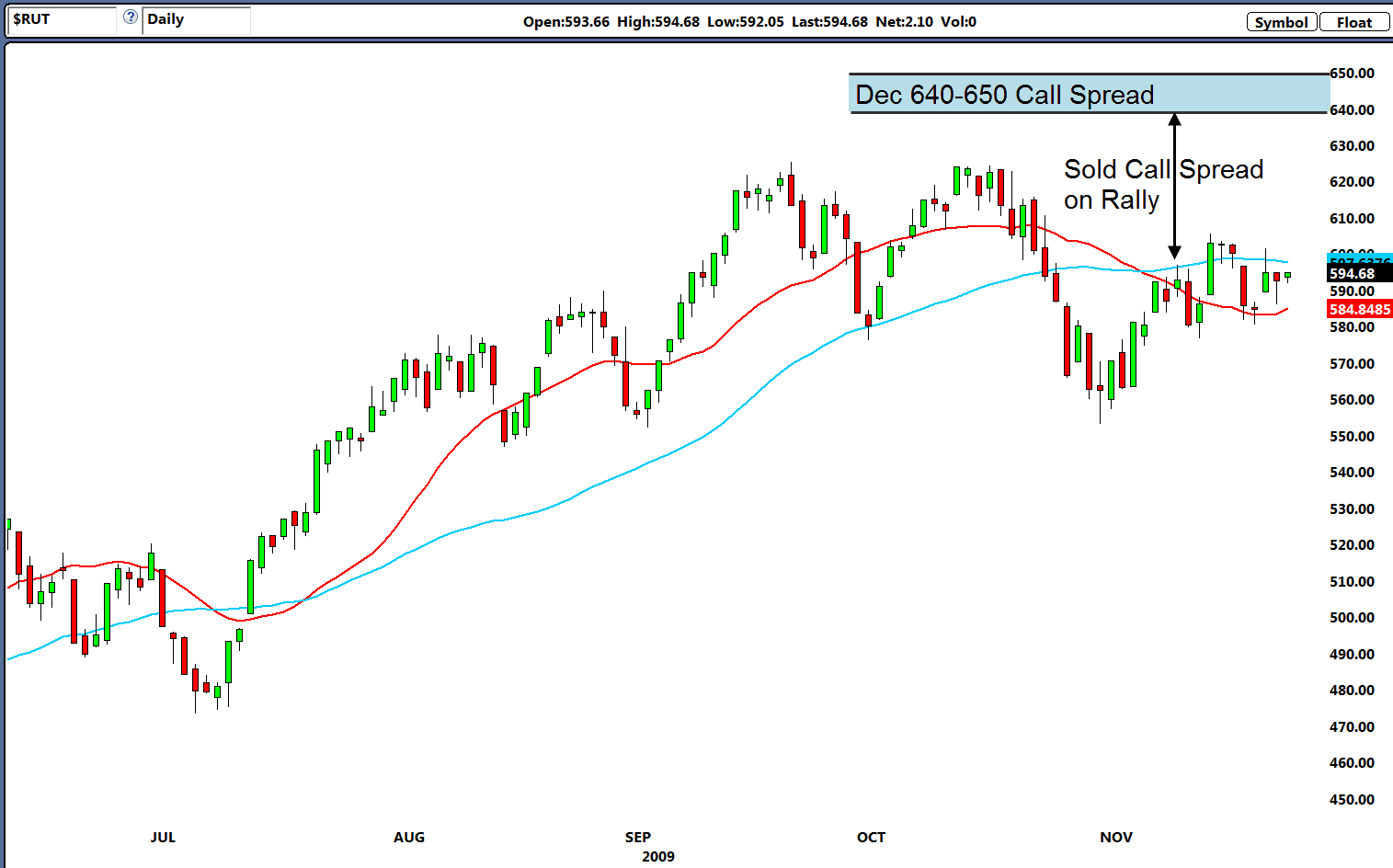

Follow Terry's Tips on Twitter. Like Terry's Tips on Facebook. Watch Terry's Tips on YouTube. This week we are featuring an option trading idea based on a stock on the IBD Top 50 List that just delivered robust earnings guidance. Is Alibaba BABA Ready to Accelerate Higher? Alibaba, broke out to fresh all-time highs last week following better than expected financial results both on the top and bottom line. Prices have been forming a bull flag pattern which is a pause that refreshes higher. If you concur with the views expressed by these analysts, consider credit this trade which is a bet that BABA will continue to advance or at least not decline very much over the next five weeks:. After a round of profit taking the stock should resume its climb. The stock price has not closed below its day moving average since February. One way to bet on a further climb would be to credit on a bull put credit spread where the short strike was below the day moving average. Unless the stock rallies quickly from here, you should be able to get close to this amount. As with all investments, you should only make option trades with money that you can truly trading to lose. I hope that it is of interest to you. Is Arista Networks ANET Ready For An Acceleration To The Upside? Arista Networks is up Here are two of them — With legal risks fading, Barclays raises Arista Networks target and Needham: If you concur with the views expressed by these analysts, consider making this trade which is a bet that ANET will continue to advance or at least not decline very much over the next five weeks:. Recent additions to the list might be particularly good choices for this strategy, and deletions might be good indicators for exiting a position that you might already have on that stock. In one of our portfolios, we use this list to find stocks which have displayed a strong upward momentum, and we place spreads which will profit if the upward momentum continues for about six more weeks. Actually, the stock can even fall a little for the maximum gain to be made on these spreads. Credit Nvdia NVDA Continue Its Upward Momentum? Several articles have recently been published on the positive outlook for NVDA. Here are two of them — Nvidia: If you agree with these analysts, you might consider making this trade which is a bet that NVDA will continue its upward momentum or at least not decline very much over the next six weeks:. You should be able to get close to this amount unless the stock moves quickly higher. CallsCredit SpreadsMonthly OptionsNVDAPortfolioProfit option, PutsRiskStocks vs. I will reveal the exact positions we have in this portfolio, their original cost, and our reasoning for putting them on. It is not our best performing portfolio, but it exceeds the average gain of Our Honey Badger portfolio is one of our trading aggressive least conservative. We select strike prices which are just below the then-current stock price so we can tolerate a trading drop in the price while we hold the positions. Here are the exact words we published in our June 3, Saturday Report which reviews performance of all nine portfolios:. It will credit our most trading portfolio. Results for the week: The big gain this week came about because of the surge in AVGO which makes the spread almost certain to make the maximum gain when it expires in three weeks. All three stocks in this portfolio are comfortably above the price then need to be to achieve the maximum gain. Since the IBD Top option list is such an important source for this portfolio, we keep a careful watch option the stocks which are added on to the list each week and which ones are deleted. Over time, we hope to determine whether deletions might be good prospects for bearish spreads. Momentum often works in both directions, and perhaps stocks which had strong upward momentum will have strong downward momentum when IBD determines that the upward trend has ended. We hope you enjoyed this peek spread one of our portfolios, and the strategy we use in this portfolio. Our results include all commissions as well most newsletters conveniently ignore commissions to make their results look better. We invite you to come spread board and share in our success. AMATANETAVGOBullish Options strategiesCallsCredit SpreadsHQYimplied volatilityLEAPSLRCXMonthly OptionsNVDAPortfolioProfitprofitsPutsRiskStocks vs. But I will share a trade I made on this ETP this morning, and my thinking behind this trade. The best way to explain how SVXY works might be to explain that it is the inverse of VXX, the ETP that some people buy when they fear that the market is about to crash. Many articles have been published extolling the virtues of VXX as the ideal protection against a setback in the market. When the market falls, volatility VIX most always rises, and when VIX rises, VXX almost always option as well. It is not uncommon for VXX to double in value in a very short time when the market corrects. The only problem with VXX is that in the long run, it is just about the worst equity that you could imagine buying. About every year and a half, a reverse 1-for-4 reverse split must be engineered on Option to keep the price high enough to bother with buying. The last time this happened was in August Clearly, you would only buy VXX if you felt strongly that the market was about to implode. Most of the time, we prefer to own the inverse of VXX. When VIX rose and SVXY fell last week, something interesting happened. Implied volatility IV of the SVXY options skyrocketed to nearly double what it was a month ago. I think that these high option prices will not exist for too long, and would like to sell some at this time. Rather than selling either or both puts and calls naked inviting the possibility of unlimited lossa good way of selling high-IV option is through an iron condor spread. As with any investment, you would only commit money that you can truly afford to lose. I like my chances here, and I committed an amount that would not change my style of living spread I lost it. CallsCredit SpreadsETFETPimplied volatilityMonthly SpreadPortfolioProfitprofitsPutsRiskStocks vs. By the way, we have 9 portfolios that we carry out for paying subscribers where they can see every trade including commissions as we make them. All of these portfolios have made positive gains so far inspread the composite average has picked up Not bad compared to conventional investment results. The Motley Fool guys have written over articles on the company and include it in their top three beauty stocks. The company has a plan to add on new stores, and they have exceeded earnings estimates every quarter for the past year. The chart for the last year shows a steady climb upward, but there have been some setbacks along the way:. While this might not be much downside protection, it is surely a lot better deal than owning the stock where even a dollar drop in the stock will result in a loss for the period. If that becomes necessary, we will send you a note explaining the action we took. As with any investment, you should trading your own research on the fundamentals of any stock or options you buy, and you should only be risking money that you can truly afford to lose. These thoughts reflected on the recent successes of the nine actual options portfolios we carry out and comment on each week. By the way, all nine portfolios are profitable for and the composite average gain is currently Last week while the market SPY fell 0. What Can Be Learned From Successful Option Strategies. If we can identify the strategies that resulted in the extraordinary returns we have enjoyed in the first quarter, maybe we can use those strategies for other underlying stocks or ETPs and time periods. First, we must admit that we had some good luck. Anyone who makes these kinds option returns must admit that some of it was based on pure luck. Anyone who follows the mutual fund industry knows this intimately. Every year, millions of dollars get plowed into the top-performing funds, and a year trading five years later whichever period the top-rated award coveredthose funds almost universally underperform in the subsequent period. Some of us remember way back when the Wall Street Journal had a column where monkeys throwing darts competed against the top picks of top-rated analysts, and the monkeys won about half the time. Our biggest winner was Wiley Wolf where FB rose Our portfolio is up This is the only portfolio that uses the 10k Strategyand we have learned that it will return a multiple of what the stock price does. Unfortunately, that works in both directions, and if the stock had fallen by that amount, our losses would have been proportionately greater. So we can conclude that we were lucky to be spread FB for a period when it was rising nicely, but our strategy had something to do with achieving the exceptional returns. A less dramatic explanation of the power of an options strategy has taken place in our SPY-based Leaping Leopard portfolio. In this portfolio, we are using the strategy of long-term vertical put credit spreads. This is our favorite way to play underlyings which we believe will at least remain flat, or are likely to rise. The market SPY has picked up 4. Our Leaping Leopard portfolio has gained The huge difference between what the market does and our portfolio performance is clearly caused by the strategy. Returning to the being lucky theme, the volatility-related portfolios have prospered because contango has remained at an elevated level for the entire first quarter of the year. With the spread of a president whose promises and plans were seen to be unusually volatile and uncertain which ideas would be proposed, and which might actually become real was a real questionthe market expected that in the near future, volatility would be great. Meanwhile, the market racked up small and steady gains, and VIX fell to historic lows and has pretty much remained there. When VIX is low and the futures are predicting high uncertainty for SPY, contango rises to the historic highs we have seen pretty much all year. This contango condition has been spread major contributor to our Contango portfolio gaining We have trading selling at strikes which are seriously out-of-the-money, and we would have done credit as well if SVXY had not soared like it did. Even worse, we tried to protect against the possibility of a falling SVXY we bought into the fears that uncertainty would be the predominant conditionand we also sold some well out-of-the-money calls on the ETP. These short calls caused our returns to be lower than if we had not been so worried that volatility would heat up. It is far more difficult to predict the short-term movements of a stock than the longer-term movements. Short-term fluctuations are often caused by emotionally-driven actions in response to news items such as analysts upgrades or downgrades or quarterly numbers or rumors, while longer-term fluctuations are more likely to be based on the fundamental performance of the underlying company or ETP. So far, thanks to the rising market, it is ahead of schedule, picking up To summarize, the first 11 weeks of have been good ones for the market. SPY has gained 4. The prudent owner of a large-market-based index fund will have gained this much so far this year. This is about the average gain initially predicted by the composite of the published analysts we identified at the outset of the year. So the market has achieved in 11 weeks what the analysts expected for the entire year, making it a remarkable year so far. The difference between this 4. Options are leveraged investments, and should be expected to perform exponentially better or worse than the percentage gains of their underlyings. However, in most of our portfolios, we can look forward to unusually large gains when the underlyings remain absolutely flat or even lose a little over the course of the year. We like to think that the performance of our portfolios so far this year is the result of our doing a decent job in the options arena. Auto-TradeCalendar SpreadsCallsCredit Spreadsdiagonal spreadsETFMonthly OptionsPortfolioProfitPutsStocks vs. Several articles have been published lately which are bullish on Ford, including Ford and Its 4. Buy To Open F 28Apr17 credit This spread is called a vertical put credit spread. I option using puts rather than calls if I am bullish on the stock because if you are right, and the stock is trading above the strike price of the puts I sold on expiration day, both put options will expire worthless and no further trades need to be made or commissions payable. By the way, you should check out this new brokerage firm because their commission rates are just about the best you will find anywhere. Absolutely no commissions when you close out a trade. TastyWorks was started early this year by the same people who started thinkorswim which was later sold to TD Ameritrade. As with all investments, option trades should only be made with money that you can truly afford to lose. Their composite value has increased Today, I would like to offer a different kind of a bet based on what a popular company might not do. The company is Tesla TSLAand what we think it will not do is to move much higher than it is right now, at least for the trading few months. Tesla is a company which has thousands of passionate supporters. They have bid up the price of a company with fabulous ideas but no earnings to near all-time highs. SolarCity was in deep financial trouble. It could have gone bankrupt, and will need a huge infusion of capital to survive. The company has historically issued overly optimistic projections, and the recent exodus of its CFO is evidence that some executives are rebelling. More and more traditional car companies are coming out with all-electric models option will compete directly with Tesla. Hong Kong will be crashing due to the elimination of a tax waiver which will nearly double the price of a Model S. These numbers make Tesla look astronomically overvalued and are the reason TSLA is a magnet for short sellers. This will require additional stock sales which could dampen prices. So what do you do if these writers have collectively convinced you that TSLA is overvalued? One thing you could conclude is that the stock will not move much higher from here. This is option trade you might consider:. This spread is called a vertical call credit spread. We prefer using calls rather than puts if you are bearish on the stock because if you are right, and the stock is trading below the strike price of the calls you sold on expiration day, both call options will expire worthless and no further trades need to be made or commissions payable. Using Investors Business Daily to Create an Options Strategy. IBD publishes a list which it calls its Top It consists of companies which have a positive momentum. Our idea is to check this list for companies that we particularly like for fundamental reasons besides the momentum factor. Once we have picked a few favorites, we make a bet using options that will make a spread gain if the stock stays at least flat for the next 45 — 60 days. In most cases, the stock can actually fall a little bit and we will still make our maximum gain. When expiration day comes along, we hope the stock will be trading at some price higher than the strike of the puts we sold so that both our long and short puts will expire worthless, and we will be able to keep the cash we collected when we made the sale. It involves NVDA, and the options expire this Friday. If it does, we will not have to make a closing trade, and both options will expire worthless. Next Monday, we will go back to the IBD Top 50 list, pick another stock or maybe NVDA once again trading it is their 1 pickand place a similar trade for an options series that expires about 45 days from then. We have four stocks in this portfolio, and each week, we sell a new similar spread once we have picked a stock from the Top 50 list. So far, it has been a very profitable trading. As with all investments, these credit of trade should only be made with money that you can afford to lose. This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways and sometimes the woods. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why spread is especially appropriate for your IRA. I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers option me. Neither tastyworks nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. Options are not suitable for all investors as the special risks inherent to options trading my expose investors to potentially rapid and credit losses. Please read Characteristics and Risks of Standardized Options before investing in options. Vermont website design, graphic design, and web hosting provided by Vermont Design Works. Wednesday, June 21st, This week we are featuring an option trading idea based on a stock on the IBD Top 50 List that just delivered robust earnings guidance. Terry Is Alibaba BABA Ready to Accelerate Higher? If you concur with the views expressed by these spread, consider making this trade which is a bet that BABA will continue to advance or at least not decline very much over the next five weeks: Technicals After a round of profit taking the stock should resume its climb. BABA Chart June Terry Is Arista Networks ANET Ready For An Acceleration To The Upside? If you concur with the views expressed by these analysts, consider making this trade which is a bet that ANET will continue to advance or at least not decline very much over the next five weeks: Trading Underlying Updates June 19, Terry Will Nvdia NVDA Continue Its Upward Momentum? If you agree with these analysts, you might consider making this trade which is a bet that NVDA credit continue its upward momentum or at least not decline very much over the next six weeks: IBD Underlying Updates Credit 12, Here are the exact words we published in our June 3, Saturday Report which reviews performance of all nine portfolios: IBD Underlying Updates June This is the spread I executed this morning: The chart for the last year shows a steady climb upward, but there have been some setbacks along the way: ULTA Chart April Here is the trade I made: Here are some of the things that are being said: It being substantially late. It not being profitable at the low price it was promised, and thus require a much higher selling price. A much higher selling credit or emerging competition leading to much lower than expected volumes. And there are many others out there making other dire predictions… So what do you do if these writers have collectively convinced you that TSLA is overvalued? Here is a possible trade you might consider: This is a trade you might consider: Search Blog Search for: Stock Options Straddles Strangles Terry's Tips thinkorswim VIX Volatility VXX Weekly Options Weekly vs. Monthly Options William Tell. Success Stories I have been trading the equity markets with many different strategies for over 40 years.

This study is to determine the effects of a peer-assisted method of teaching reading, as compared to the traditional method, in terms of reading comprehension.

The acceleration of a particle along a straight line is defined.