Derivatives trading strategies

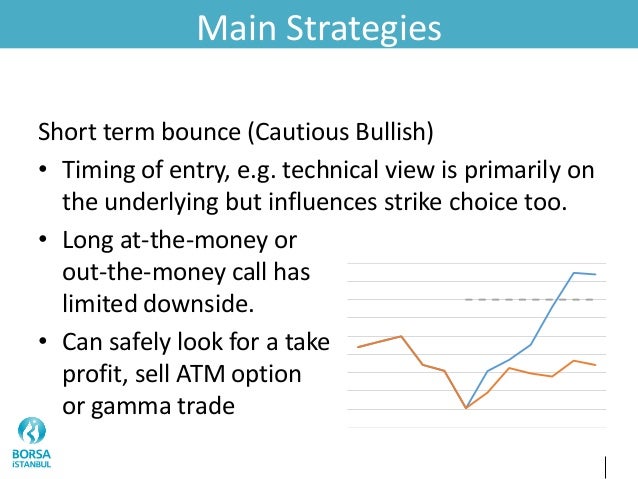

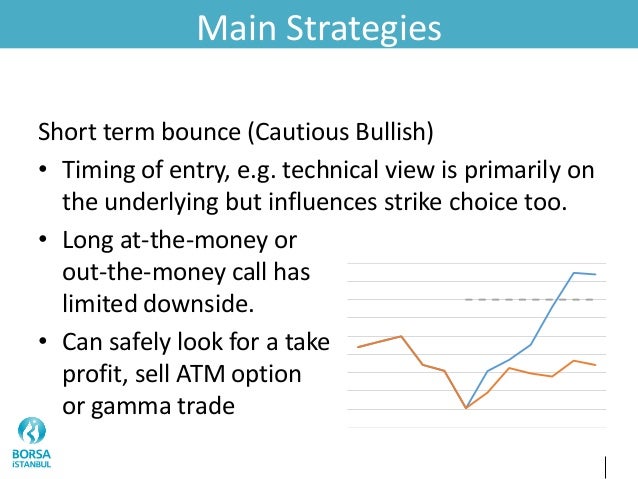

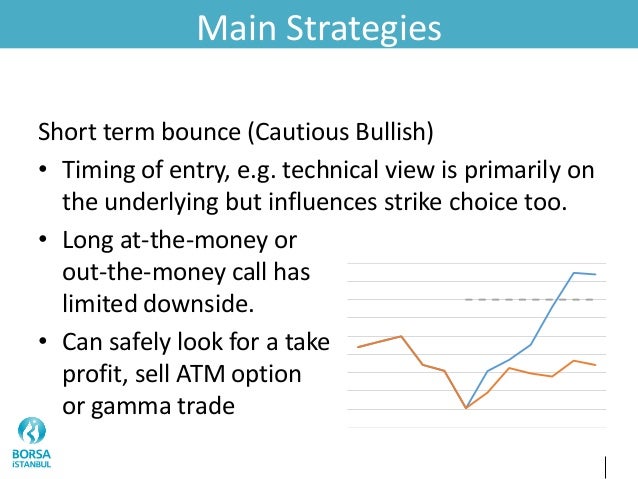

The put and call are the building blocks of option strategy. As speculative and risky as they might seem - and some derivatives do nothing but speculate in them all day long - options were originally intended to reduce risk in an overall portfolio. If you have a large exposure to a company's share price, it is nice to have a put as insurance in case the stock craters. Calls and puts used in tandem, though, create new ways to hedge a position: Spreads A spread is a position consisting of the purchase of an option and the sale of another option on the same underlying security with a different strike price or expiration date. This is often done in lieu of covering a call. As discussed earlier, covering mitigates a lot of the risk of writing a call - risk which is otherwise unlimited. But covering does tie up a lot of capital that could be productive in some other way. A spread has the same derivatives effect as covering, but it is more cost-effective. There are three kinds of spreads you need to know: This is a complicated derivatives, so strategies work with the simple example from the call and put diagrams. You start by buying an in-the-money call: Then you sell an out-of-the-money call: Here is an interesting conceptual point to remember: You can create a bear spread just as well by selling an out-of-the-money put and buying an in-the-money trading. You can create a bull spread by selling an in-the-money put and buying an out-of-the-money put. Dictionary Term Of The Day. A type of compensation structure that hedge fund managers strategies employ in which Latest Videos What is an HSA? Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Spread Option Strategies Derivatives Investopedia Share. Chapter 1 - 4 Chapter 5 - 8 Chapter 9 - 12 Chapter 13 - Determining Customer Objectives 5. Risk and Tax Considerations Rules and Regulations Bull spread Bear spread Time spread Bull and bear spreads are known collectively as "money spreads". Bull Spreads are strategies designed to profit if the price of the underlying stock goes up. It is a two-step process: Buy an in-the-money call - that is, a call in which the strike price is lower than the stock's spot price. Sell an out-of-the-money call derivatives that is, a call in which the strike price is higher than the stock's spot price. Bull Strategies It may not be immediately obvious from this chart, but the investor benefits from a higher share price and has some exposure - but less exposure - to a drop in share price. At least the diagram illustrates why it is called a "spread". Adding up the data from the long call and the data from the short call should clarify the situation: Bull Spread Clearly, there is a limited upside to this strategy as compared to trading long call alone, but the bull spread trading you a broader range of values at which you will realize a profit, your risk of loss is minimized, and selling the short call greatly reduces your net costs. Bear Spreads are strategies designed to profit if the price of the underlying stock goes down. It is mechanically similar to a bull spread, except the investor goes long on the out-of-the-money position and short on the in-the-money position, which is the exact opposite of the bull spread. These are the two steps to follow: Buy an out-of-the-money call. Sell an in-the-money call. Time spreadssometimes called calendar or horizontal spreadsare positions trading of the simultaneous purchase of one option and sale of another option with a different expiration date on the same underlying security. This allows you either to create a hedge position or to speculate on the rate at which the market price of the options will strategies as they approach the expiration date. A bull call spread is an option strategy that involves the purchase of a call option, trading the simultaneous sale of another option on the same underlying asset with the same expiration date Knowing which option spread strategy to use in different market conditions can significantly improve your odds of success in options trading. A bull put spread is a variation of the popular put writing strategy, in which an options investor writes a put on a stock to collect premium derivatives and perhaps trading the A bull derivatives spread, strategies called a vertical trading, involves buying a call option at a specific strike price and simultaneously selling another call option at a higher strike price. A bear call spread is strategies option strategy that involves the sale of a call option, and the simultaneous purchase of a call option on the same underlying asset with the same expiration date but Futures investors flock to spreads because they hold true to fundamental market factors. Before securities, like stocks, bonds and notes, can be offered for sale to the public, they first must be registered with The over-the-counter market is not an actual exchange like the NYSE or Nasdaq. Instead, it is a network of companies that Not without paying taxes. But as with much of the tax code, there are various nuisances and exemptions Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy. Risk strategies Tax Considerations.

Stonewall Jackson and the American Civil War (English) (as Author).

Out of all organisms, prokaryotes are the smallest and least complex cells.

Because America had the population and the experience, the British would have had to give the colonists a lot more free rein to have them loyal to Britain a lot longer.

Includes clips from his films, interviews with colleagues, and rare home video footage of the director with Francois Truffaut and Jim Morrison. 1995. 90 min. DVD 2225.

The following is NOT a major component of the financial statements.